HOMCOM Relógio de Parede Silencioso de Ø60 Relógio de Parede de Metal e Madeira Estilo Moderno Multicor | AOSOM Portugal

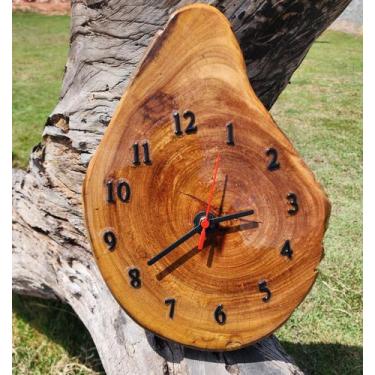

Relógio de parede rústico retrô de madeira 12 polegadas, estilo nodico, relógio de parede, anel para crescimento, arte em casa, escritório, decoração de café - AliExpress

Relógio de parede rústico retrô de madeira 12 polegadas, estilo nodico, relógio de parede, anel para crescimento, arte em casa, escritório, decoração de café - AliExpress

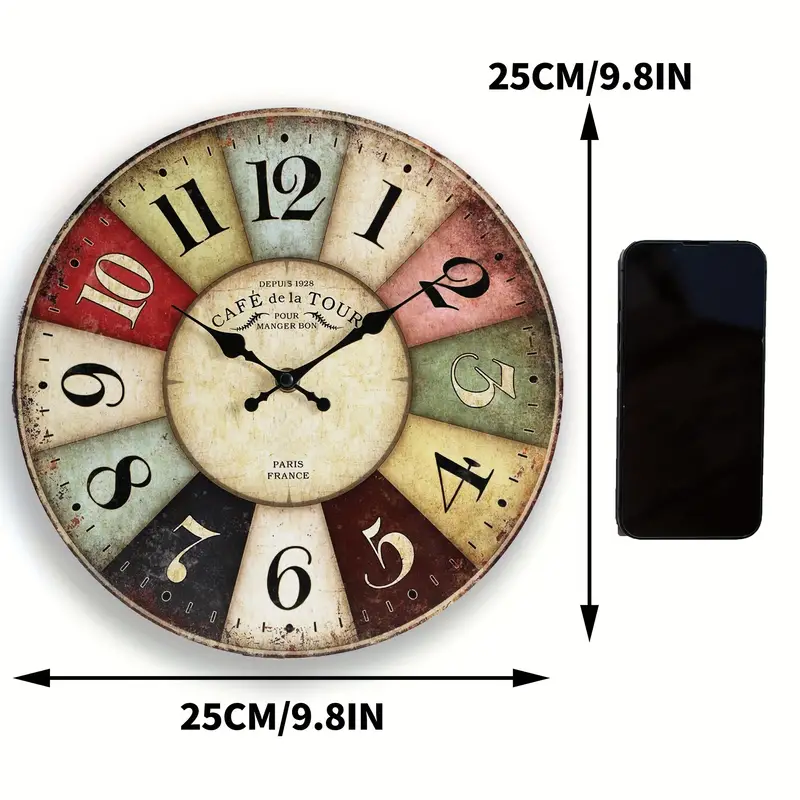

1 Peça Relógio De Parede De Madeira MDF Vintage Rústico Country Redondo Decorativo Relógio De Parede De Quartzo Estilo Retro (10 Polegadas, Colorido) - Temu Portugal